For those who qualify, the new FHA Streamline refinance will save a lot of money. įHA Mortgage Insurance Increase and FHA Streamline RefinancesįHA announced a new lower cost FHA streamline refinance program for FHA loans endorsed before June, 2009.

ONE TIME UP FRONT MIP MAC

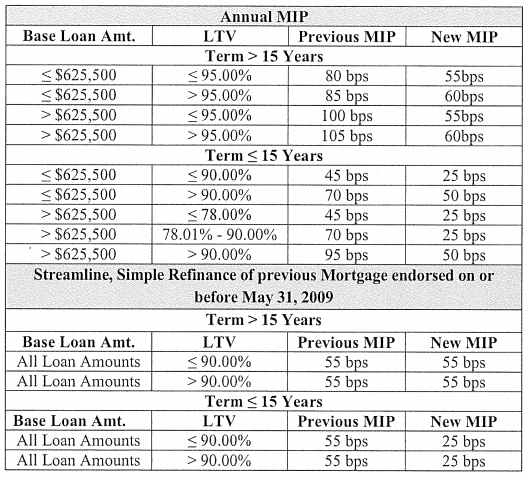

Our fine upstanding congressman and congresswoman are taxing home buyers and home owners by charging taxes through FHA, Fannie Mae and Freddie Mac to fund the Temporary Payroll Tax Cut Continuation Act of 2011. Fannie and Freddie are also trying to reduce the amount of loans they buy and securitize so they to are raising fees. Other sources? Yeah, I know, the only other source is the government owned/run/subsidized agencies of Fannie Mae and Freddie Mac. By increasing mortgage insurance premiums, borrowers will look to other sources for home financing. FHA has mentioned many times they would like to decrease the number of loans they insure.Since 2008, FHA has paid out $37 BILLION in claims to cover losses. FHA’s Mutual Mortgage Insurance (MMI) fund is running below the mandated threshold due to default losses and payouts on insurance claims……homes that foreclosed and FHA paid the claim to the lender.Why Is FHA Making FHA Financing More Expensive? In 2011 I reported on how FHA raised the mortgage insurance fee in 2011 and wasn’t about to stop there. Remember, FHA has been steadily raising their mortgage insurance fees over the last 3-4 years and we just react like a frog in boiling water. The chart below (for illustrative purposes only….rates are actually lower today) shows how much your payment will increase starting April 1st, 2012 for a 30 year fixed loan with 3.5% down. How Does the FHA Mortgage Insurance Increase Affect Me? This insurance is a guarantee to lenders that the mortgages it backs will be paid in case of default. The Annual insurance is collected monthly with your payment and taking effect April 9th, 2012, with the high balance increase beginning June 11, 2012. The FHA Annual Mortgage Insurance Premium is increasing from 1.15% to 1.25% for borrowers with loans under $625,500 and up to 1.45% for lhigh balance loan amounts between $625,500 and $729,500. This increase is scheduled to take place April 9, 2012….no joking. This 1.75% UFMIP fee is then added to the base loan amount. The Up Front Mortgage Insurance Premium is a one time fee, now at 1.75% of the loan amount, that is paid directly to HUD/FHA. What is the Difference Between UFMIP and Annual (monthly) FHA Mortgage Insurance?įHA loans have two types of mortgage insurance. The increase will add about $30/month to the payment for the average California Home buyer. FHA also announced the Annual (paid monthly) monthly insurance premium will increase from 1.15% to 1.25% for loans under $625,500 and up to 1.5% for loans over that amount. The Federal Housing Administration (FHA) announced they are increasing the cost of their Up Front Mortgage Insurance Premium (UFMIP) on FHA single family insured mortgage loans from 1.0% to 1.75%. roofing, HVAC) may be replaced.By Brad Yzermans on Februin FHA Mortgages No more than half of any essential structural component (e.g. If the second or third calculation is used, repairs are limited to $15,000/unit (more in high-cost areas). Repair Limitations: While the 223(f) program is not intended for substantial rehabilitation, loan funds may be used for repairs of up to $6,500/unit (more in high-cost areas), or 15% of the property value, or 20% of the mortgage.At that point, 50% of funds above 80% adjusted LTV are released, with the remaining 50% to be released after property rehab is complete. LTV must be at least 80% (including transaction costs in the loan amount). Cash Out: For 223f refinances, cash out is allowed under specific conditions.FHA Application Fee: 0.30% of the total loan amount.0.25% for Energy Star SEDI (Statement of Design Intent) certified properties.0.45% for affordable properties (typically must be Section 8 or new money LIHTC projects to qualify).MIP: 1% upfront mortgage insurance premium for all property types, then, annual MIP of:.Rental assistance properties: 1.11x minimum DSCR.Affordable properties: 1.15x minimum DSCR.Market rate properties: 1.17x minimum DSCR.Interest Rates: Fixed, terms range from 4.10% to 4.75% (including MIP), as of Jan.Rental assistance properties: 87% LTV, 90% LTV for properties with 90% or more rental assistance.Loan Term: Minimum loan term of 10 years, and a maximum term of 35 years (or 75% of the property's remaining economic life).Loan Amount: Minimum loan amount of $1 million (exceptions can be made on a case by case basis).

Generally, the requirements are as follows:

ONE TIME UP FRONT MIP FULL

The HUD 223(f) loan program has a full checklist of requirements, which can be found here.

0 kommentar(er)

0 kommentar(er)